-

Asia Platform

某公司刚刚进行了A轮融资,预计将把现金跑道延长15个月,届时公司预计将达到一定的估值。然而,在完成 A 轮融资两个月后,该公司意识到有机会在该地区开辟一个新市场(加速增长),并希望抓住这个机会,但没有分配额外的资金。该公司陷入了困境——要么使用其 A 轮资金来加速增长,从而将其现金跑道缩短到不到 15 个月,要么决定错过机会,也错过了提高估值的可能性。

获得创业另类融资可以解决这一问题。通过资金,该公司无需在短短 2 个月后以同样A轮的价格继续寻求股权投资者的额外资金,也无需减少现金跑道并放弃已经为未来 15 个月规划的预算。通过获得资金,该公司将能够抓住新机会,维持 15 个月的现金跑道,甚至可能在此期间提高估值。

一家 B 轮融资公司正在寻求额外的营运资金流动性。作为先进制造商,公司需要提前3个月准备原材料,以确保生产能够顺利进行。此外,该公司为其下游客户提供了1-2个月的长拖欠周期,导致4-5个月的营运资金周期总体不匹配。

解决方案是 B 轮融资的同时或之后使用创业另类融资,以便在营运资金周期中获得额外的流动性。公司可以利用资金来缓冲原材料的采购,然后用下游客户的货款偿还,以便将股权资本分配到研发或资本支出投资等其他方面。

某家公司寻求到了收购一家公司以加速其自身业务的机会。正在进行谈判希望获得额外股权融资进行收购,但金额确达不到新一轮融资的规模。

解决方案是使用创业另类融资进行并购。该公司可以获得收购所需的额外资金,同时防止融资规模过小或者估值不涨的情况。抓住了潜在的机会,公司可以利用它来加速增长并在下一轮股权中以更高的估值筹集资金。

In this scenario, the company has just raised a Series A round, which is expected to extend its cash runway for 15 months at which point the company has projected to achieve a certain valuation. However, two months after closing its Series A, the company realizes that there is an opportunity to open a new market in the region (accelerate growth), and wants to seize the opportunity but did not allocate extra cash to do so. The company is left with a predicament – it can either use its Series A funds towards accelerating growth and thus reducing its cash runway to less than 15 months, or it can decide to miss the opportunity and therefore also miss the potential to increase its valuation.

A solution would be to take a venture loan. By taking a loan, the company does not need to return to its equity investors after a short 2-month period to ask for additional capital at a similar valuation as its Series A round and it does not need to reduce its cash runway and give up opportunities that were already budgeted for in the next 15 months. By taking a venture loan, the company would be able to seize the new opportunity, maintain its cash runway of 15 months and even potentially increase valuation in that time.

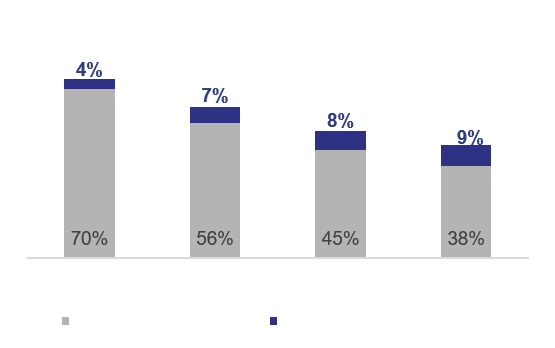

In this scenario, the company has just raised a Series A round, which is expected to extend its cash runway for 15 months at which point the company has projected to achieve a certain valuation. However, things do not always go as planned and the company was unable to meet its projected milestones due to unexpected delays. Therefore, it burnt through the capital raised in its Series A round and will likely raise a flat Series B round.

A solution could have been to raise a venture loan alongside its Series A round in order to plan (cushion) for the unexpected scenario that it would not meet its projected plan. Thus, the company would have likely been able to extend its cash runway and achieve the necessary milestones prior to running out of cash and having to raise a Series B round of financing.

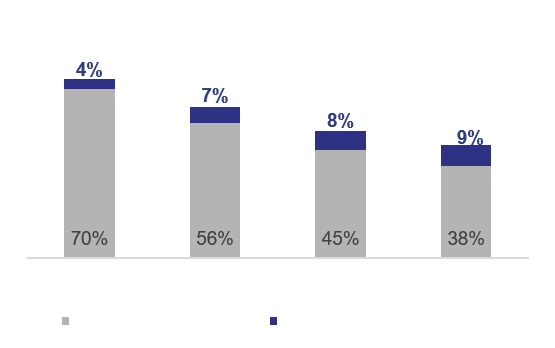

In this scenario, a company is looking to raise a Series B round. Its founders are hesitant, as raising a round now would mean they would have to dilute their shareholding even further and lose control of the company.

A solution could be to raise a venture loan alongside its Series B round by raising a part-equity and part-debt round. By doing so, it would allow the company to raise its desired amount of capital, adhere to a venture lender’s typical expectation to come alongside an equity financing round and most importantly allow the founders to reduce their equity dilution.

In this scenario, the company has just raised a Series A round, which is expected to extend its cash runway for 15 months at which point the company has projected to achieve a certain valuation. However, two months after closing its Series A, the company realizes that there is an opportunity to open a new market in the region (accelerate growth), and wants to seize the opportunity but did not allocate extra cash to do so. The company is left with a predicament – it can either use its Series A funds towards accelerating growth and thus reducing its cash runway to less than 15 months, or it can decide to miss the opportunity and therefore also miss the potential to increase its valuation.

In this scenario, the company has just raised a Series A round, which is expected to extend its cash runway for 15 months at which point the company has projected to achieve a certain valuation. However, two months after closing its Series A, the company realizes that there is an opportunity to open a new market in the region (accelerate growth), and wants to seize the opportunity but did not allocate extra cash to do so. The company is left with a predicament – it can either use its Series A funds towards accelerating growth and thus reducing its cash runway to less than 15 months, or it can decide to miss the opportunity and therefore also miss the potential to increase its valuation.

In this scenario, the company has just raised a Series A round, which is expected to extend its cash runway for 15 months at which point the company has projected to achieve a certain valuation. However, two months after closing its Series A, the company realizes that there is an opportunity to open a new market in the region (accelerate growth), and wants to seize the opportunity but did not allocate extra cash to do so. The company is left with a predicament – it can either use its Series A funds towards accelerating growth and thus reducing its cash runway to less than 15 months, or it can decide to miss the opportunity and therefore also miss the potential to increase its valuation.

In this scenario, the company has just raised a Series A round, which is expected to extend its cash runway for 15 months at which point the company has projected to achieve a certain valuation. However, two months after closing its Series A, the company realizes that there is an opportunity to open a new market in the region (accelerate growth), and wants to seize the opportunity but did not allocate extra cash to do so. The company is left with a predicament – it can either use its Series A funds towards accelerating growth and thus reducing its cash runway to less than 15 months, or it can decide to miss the opportunity and therefore also miss the potential to increase its valuation.

In this scenario, the company has just raised a Series A round, which is expected to extend its cash runway for 15 months at which point the company has projected to achieve a certain valuation. However, two months after closing its Series A, the company realizes that there is an opportunity to open a new market in the region (accelerate growth), and wants to seize the opportunity but did not allocate extra cash to do so. The company is left with a predicament – it can either use its Series A funds towards accelerating growth and thus reducing its cash runway to less than 15 months, or it can decide to miss the opportunity and therefore also miss the potential to increase its valuation.

In this scenario, the company has just raised a Series A round, which is expected to extend its cash runway for 15 months at which point the company has projected to achieve a certain valuation. However, two months after closing its Series A, the company realizes that there is an opportunity to open a new market in the region (accelerate growth), and wants to seize the opportunity but did not allocate extra cash to do so. The company is left with a predicament – it can either use its Series A funds towards accelerating growth and thus reducing its cash runway to less than 15 months, or it can decide to miss the opportunity and therefore also miss the potential to increase its valuation.

The company has just raised a Series A round, which is expected to extend its cash runway for 15 months at which point the company has projected to achieve a certain valuation. However, two months after closing its Series A, the company realizes that there is an opportunity to open a new market in the region (accelerate growth), and wants to seize the opportunity but did not allocate extra cash to do so. The company is left with a predicament – it can either use its Series A funds towards accelerating growth and thus reducing its cash runway to less than 15 months, or it can decide to miss the opportunity and therefore also miss the potential to increase its valuation.

A solution would be to take a venture loan. By taking a loan, the company does not need to return to its equity investors after a short 2-month period to ask for additional capital at a similar valuation as its Series A round and it does not need to reduce its cash runway and give up opportunities that were already budgeted for in the next 15 months. By taking a venture loan, the company would be able to seize the new opportunity, maintain its cash runway of 15 months and even potentially increase valuation in that time.

In this scenario, a Series B round company is seeking extra working capital liquidity. As an advanced manufacturer, the company needs to prepare for raw materials 3 months prior to ensure the productions could be conducted smoothly. In addition, the company offered a long backpay cycle of 1-2 months for its downstream customers, which resulted in an overall mismatch of the working capital cycle of 4-5 months.

A solution could have been to raise a venture loan alongside or right after its Series B round in order to gain additional liquidity on the working capital cycle. The company can use venture debt to cushion for the purchase of the raw materials and later then repay with its payment from downstream customers so that equity capital could be allocated on other aspects like R&D or CAPEX investments.

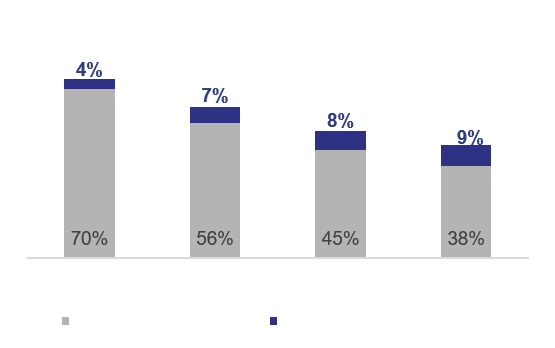

In this scenario, a company realized an opportunity to acquire a company to accelerate its own business. It is in the midst of negotiating and requires extra capital for the acquisition, but the amount is not enough for an additional equity round (maybe need to be raised at a flat round)

A solution could be to raise venture loans to especially for the M&A action. The company could gain the extra capital needed for the acquisition while preventing a small or even flat equity round. The potential opportunity is captured, the company could use it to accelerate growth and raise at a higher valuation in the next equity round.